Today was an interesting day. We were waiting for results of talks between SYRIZA and troika. SYRIZA is making it clear that they want a debt reduction. For now talks failed, but we will see more of this show in near future.

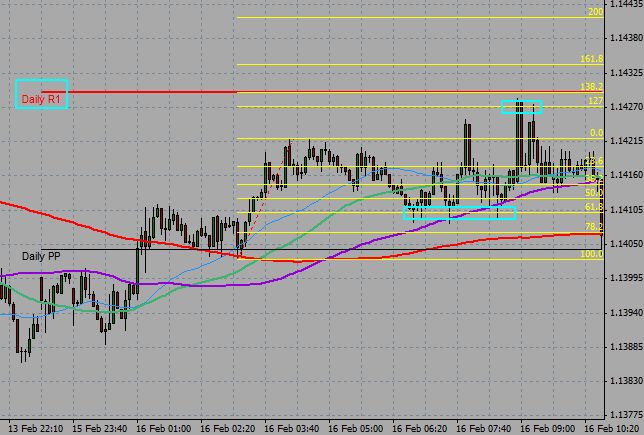

In the morning I was looking for a long trade (in the end I closed it with small loss). 100 MA (violet) and 61.8% retracement worked as a support, price was above pivot line and we saw even a move towards R1 line. It was a rapid move and it ended on 127 extension. Eur/usd 5 min.:

But later we saw a move down. It was sudden and it was because of bad news (no agreement). The answer was on higher time frame (1 hour), when we can see clear todays action:

Daily R1 and 78.2% retracement were a resistance levels. Later we saw that 55 SMA (green line) failed and right after that 100 SMA (violet).

If you were watching these levels on lower time frames you could catch that move. I have catched it on 15 min time frame. Take a look:

First 200 SMA (red) failed as a support, then we had a resistance at 55 SMA and 200 SMA failed again as a support. We also had signals from MACD and CCI. It was clear that bears are trying to go down. As you can see move ended below S2 line.

It is always important to watch other time frames. Sometimes there might be a mess on current time frame and the answers migh be on higher one.